Calculate social security wages on w2

This can be found in the Earnings section. Ad Deciding When To Claim Your Social Security Benefits Can Be Tricky.

W 2 Wage And Tax Statement Data Source Guide Dynamics Gp Microsoft Docs

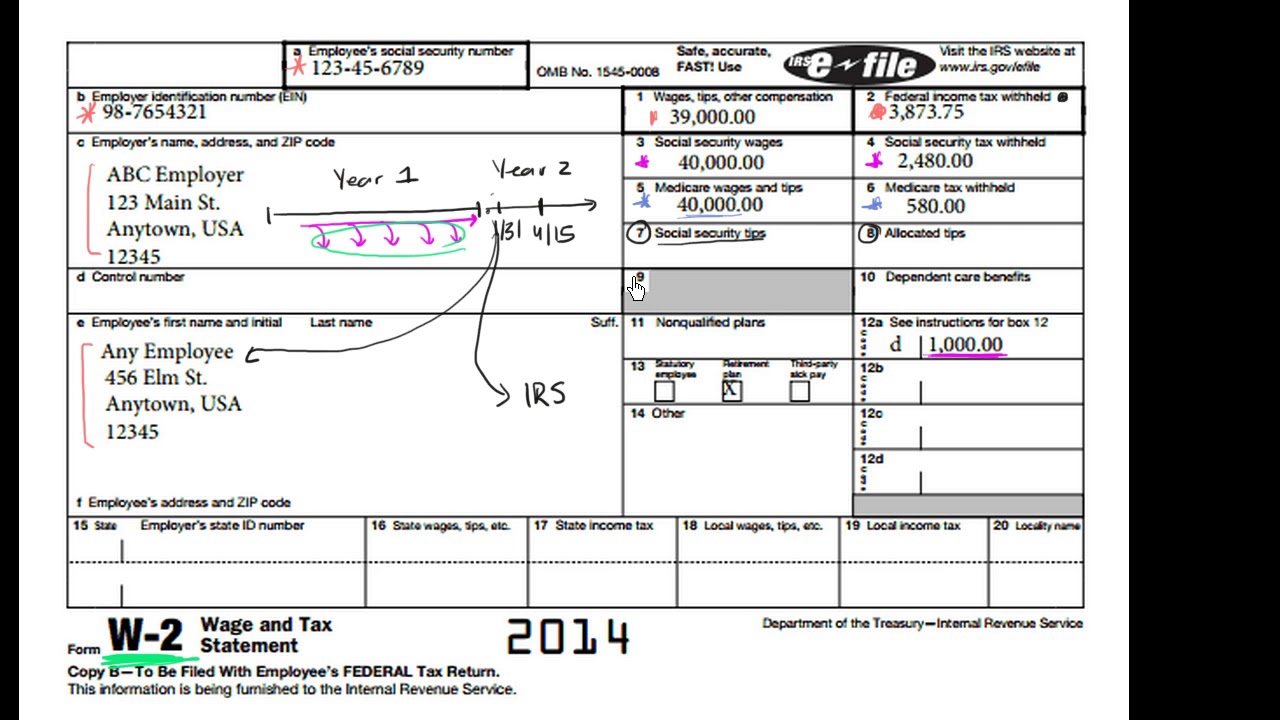

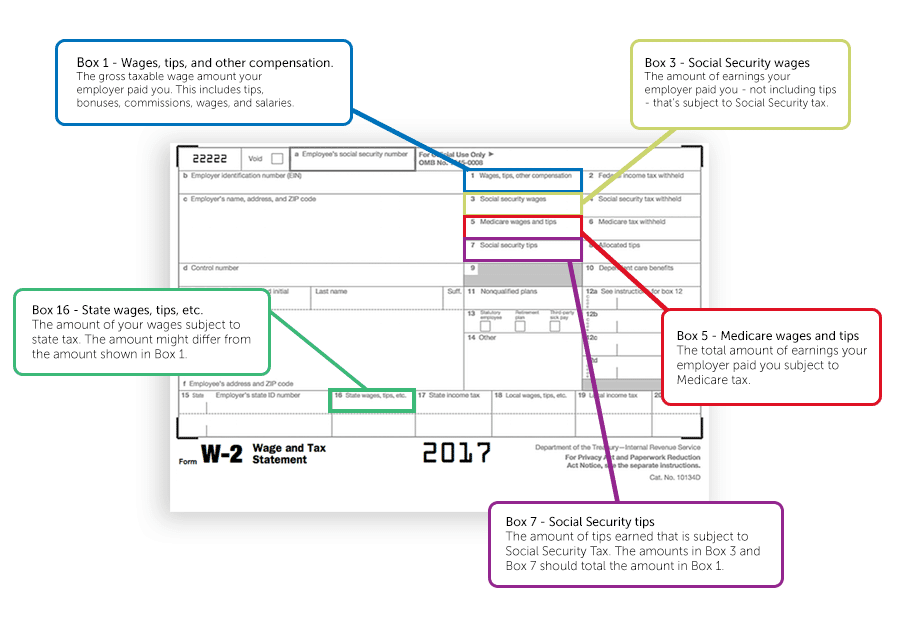

CALCULATING SOCIAL SECURITY AND MEDICARE TAXABLE WAGES BOXES 3 5 The Social Security Wage Base for 2019 was 132900.

. Calculate the social security wages if your gross earnings are 500 per month and your non taxable earnings amount to 20. Report Your Wages Without Errors. You earned more than the Social Security wage cap in a given year.

Get Your Accurate Tax Refund. You do not owe social security taxes on any money above that amount. Report Your Wages Without Errors.

Calculating your W2 wages for Medicare and Social Security taxable wages is similar to finding your taxable. However there is a maximum amount of wages that is. In 2020 this amount is 137700.

Obtain your year-to-date total gross pay from your last earnings statement for the applicable year. Social Security Quick Calculator. These tools can be accurate but require access to your official.

For security the Quick Calculator does not access your. Create A Free Account Now. The rate depends on several factors including your marital status the number of dependents pay frequency and gross income.

For security the Quick Calculator does not access your earnings. We have a variety of calculators to help you plan for the future or to assist you with your needs now. Calculating your W2 wages for Medicare and Social Security taxable wages is similar to finding your taxable income.

Your employer gives Social Security a copy of your W-2 form to report your earnings. 4 For each year you take the average wages of your indexing year which is the year you turn 60 divided. Benefit estimates depend on your date of birth and on your earnings history.

Ad Access IRS Tax Templates Online. Get Your Accurate Tax Refund. Benefit estimates depend on your date of birth and on your earnings history.

2019 Tax tables are in Publication 15. Create A Free Account Now. Get Trusted W-2 Forms - Fill Out And File - 100 Free.

When you work as an employee your wages are generally covered by Social Security and Medicare. Your wages are indexed to the average wages for the year you turn 60. Calculate Medicare and Social Security Taxable Wages.

Therefore the amount of your earnings that is taxable is 480. To determine Social Security and Medicare. 2 File Online Print - 100 Free.

Take Out The Guess Work With AARPs Social Security Calculator Earn AARP Rewards Points. Ad 1 Use Our W-2 Calculator To Fill Out Form. Go to the Payroll YTD Totals screen.

Add any contributions you IU 457b TD Account TDA. To determine your total salary from your W-2 look at your taxable wages and then consider any nontaxable wages and pretax deductions you had during the tax year. The Social Security Wage Base for 2019 was 132900.

To determine Social Security and Medicare taxable wages on your W-2 again begin with the Gross Pay YTD from your final pay. Ad Access IRS Tax Templates Online. Social Security Quick Calculator.

Get Trusted W-2 Forms - Fill Out And File - 100 Free. The following steps are an example of how to recalculate Box 3 of your W-2. Reduce Gross Pay by Non.

Intro To The W 2 Video Tax Forms Khan Academy

Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Irs Form W 2 Guide Understand How To Fill Out A W 2 Form Ageras

Form W 2 Explained William Mary

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

Understanding Your Forms W 2 Wage Tax Statement Tax Forms W2 Forms Power Of Attorney Form

W2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Form W 2 W2 Forms Irs Tax Forms Tax Forms

How To Calculate Agi From W 2 Tax Prep Checklist Income Tax Return Tax Deductions

W 2 Vs Last Pay Stub What S The Difference Aps Payroll

A Quick Guide To Your W 2 Tax Form The Motley Fool

Pin On Starting A Business Side Hustles After Divorce

Understanding Your W 2 Controller S Office

How To Read A Form W 2

Fillable Form W2 2015 Edit Sign Download In Pdf Pdfrun Irs Tax Forms Credit Card Services Tax Forms

Two Websites To Get Your W2 Form Online Online Taxes Filing Taxes W2 Forms